West Texas Intermediate traded above $82. On Wednesday, the International Energy Agency’s Fatih Birol said the relatively small hit to demand from omicron means consumption has been stronger than many observers had expected.

That followed a monthly report from the U.S. Energy Information Administration on Tuesday that showed global oil inventories will decline slightly in the first quarter, compared with a previous forecast of expansion.

The EIA’s report also showed that global oil stockpiles declined by almost 3 million barrels a day in December, underscoring recent bullish price moves. Weekly inventory figures from the U.S. are due later, though the American Petroleum Institute reported U.S. crude inventories fell by about 1 million barrels last week.

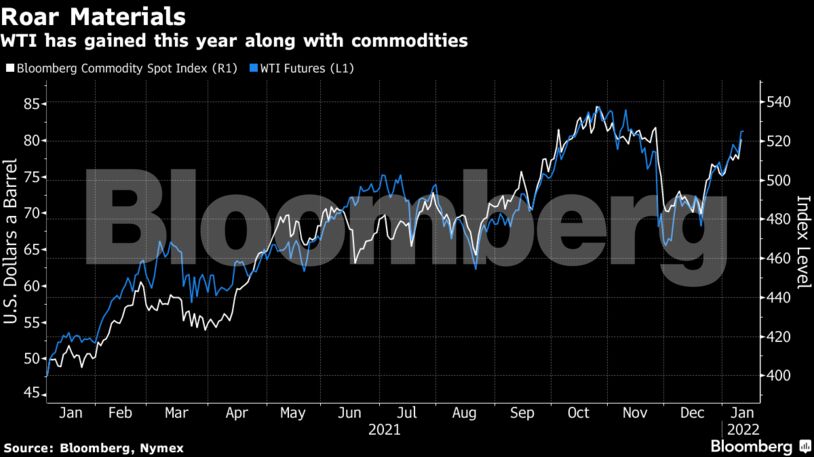

Crude’s rally on Tuesday to the highest close since Nov. 11 came alongside gains in raw materials and equities after Federal Reserve Chair Jerome Powell sought to reassure investors that the central bank can rein in inflation without damaging the U.S. economy.

See also: Commodities Price Pressures in China May Be Building Again

“Demand dynamics are stronger than many of the market observers had thought,” IEA Executive Director Birol said on a call with reporters. “Mainly due to the milder omicron expectations.”

| Prices |

|---|

|

Oil has been buffeted by wider sentiment in financial markets so far this year. U.S. consumer prices soared last year by the most in nearly four decades, illustrating red-hot inflation that sets the stage for the start of Federal Reserve interest-rate hikes as soon as March. The consumer price index climbed 7% in 2021, according to Labor Department data released Wednesday, in line with forecasts.

Official data on U.S. oil stockpiles follow later on Wednesday from the EIA. Should they confirm a drop, it would be a seventh successive fall.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS