By Ann Koh and Alex Longley

Prices for oil cargoes from Russia to Brazil have surged as fuel demand has recovered. Indian fuel sales have jumped in the first half of May and Chinese consumption has all but returned to where it was before the coronavirus outbreak. South Africa’s biggest oil refinery restarted operations as the country eases coronavirus-lockdown measures.

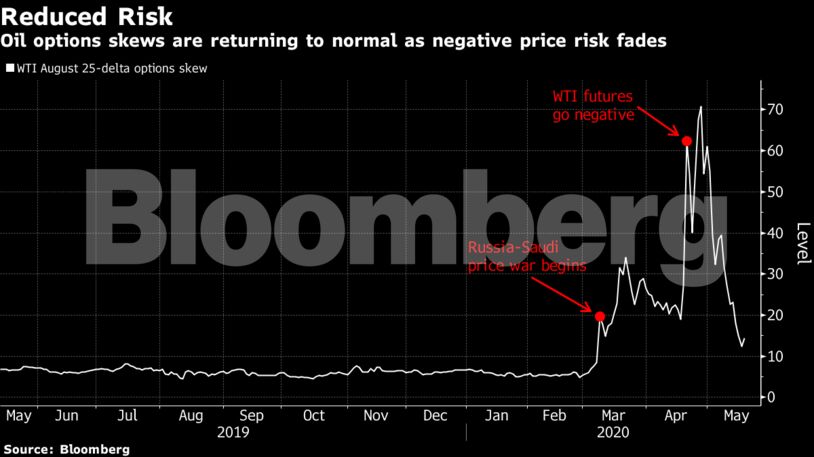

Tuesday also marks the expiry of the June West Texas Intermediate futures contract. While prices plunged at the end of the May contract’s trading period, oil has since staged a stellar recovery as producers embarked on deeper-than-expected output cuts. In a sign that the market is finding a new equilibrium, the premium traders pay for bearish put options versus bullish calls fell to the lowest since early March.

On the supply side, shale oil output from the U.S., the world’s biggest producer, is forecast to fall to the lowest since late 2018 next month, according to the Energy Information Administration. There’s also been a “stunning reversal” in OPEC+ shipments so far in May, data intelligence firm Kpler said, after the alliance’s deal to curb production kicked in at the beginning of the month.

“There’s a lot of optimism baked in here,” said Paul Horsnell, head of commodities research at Standard Chartered. “The market has balanced by supply coming off faster than expected.”

| Prices: |

|---|

|

The prospects of a rebound in consumption were buoyed on Monday after American biotechnology company Moderna Inc. said its vaccine showed signs it can create an immune-system response to the virus. Italians were allowed to go back to restaurants and New York is set to open a sixth region as some of the hardest-hit areas in Europe and North America move ahead with restarting their economies.

As the recovery gets underway, the nearest corners of the oil market are tightening sharply. WTI’s closest contract settled above the next month on Monday for the first time since January, a sign that concerns over a glut have eased.

| More oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS