By Sharon Cho and Grant Smith

Crude has been hovering around the highest levels since mid-September after the Organization of Petroleum Exporting Countries and its allies surprised the market on Friday by announcing deeper-than-forecast production cuts for next year. A report from the group on Wednesday showed that it will have to implement the agreed curbs in full — including compliance from laggards like Iraq and Nigeria — to balance markets in early 2020.

“The post-OPEC bullish jolt is all but a distant memory,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd. in London. “Oil prices have struggled for traction this week as demand concerns returned to the fore. The cautionary mood is likely to prevail as investors await fresh cues on the trade front.”

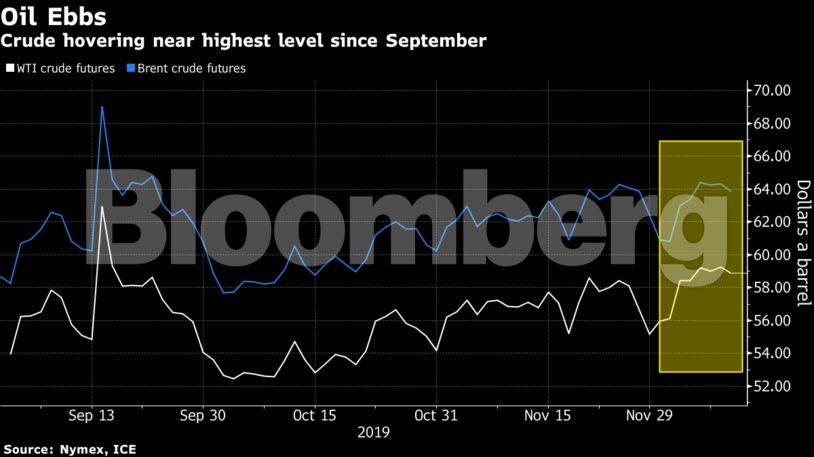

West Texas Intermediate for January delivery fell 25 cents, or 0.4%, to $58.99 a barrel on the New York Mercantile Exchange as of 8:55 a.m. local time. The contract closed up 22 cents at $59.24 on Tuesday, the highest settlement since Sept. 17.

Brent for February settlement dropped 0.6% to $63.95 a barrel on the London-based ICE Futures Europe Exchange. The global benchmark crude traded at a $5.06 premium to WTI for the same month.

The API’s stockpiles figures contrast with a Bloomberg analyst survey, which shows a 3 million-barrel decline in U.S. crude inventories. The Energy Information Administration will release official data later on Wednesday.

There’s also optimism that a limited trade deal may materialize, though there remains a lot of uncertainty. White House Trade Adviser Peter Navarro told Fox Business Network that there’s no indication President Donald Trump has made a decision either on a deal or on the tariff hike.

China and the U.S. are focusing on reducing the rate of the tariffs already in effect, rather than removing them, according to officials and other people familiar with the talks. The ongoing discussions illustrate the difficulties in reaching an accord that Trump said more than eight weeks ago was basically done and would take three to five weeks to put on paper.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS